Tax number validation

With the module, your orders will have a correct and valid tax number.

- NIP

- VAT

- VAT-EU

- VAT-UK

- Company Number

0% VAT rate automation

The module checks the validity of the tax number and sets the 0% VAT rate for B2B sales in the European Union correctly if the tax number passes validation.

Automatic downloading of data from the Central Statistical Office

For Polish companies, after entering the NIP number, the module will automatically complete the company's address data from the GUS database.

Friendly messages for customers

Tax number validation in the background during first and subsequent purchases and clear messages in the order process and customer account.

Validation of the tax number entered by the customer takes place in real time and does not require reloading the page.

1

Pre-verification

Recalculating the checksum and correcting the entry, removing unnecessary characters and completing the country code.

2

Verification in tax number databases

The module checks the tax number in official tax number databases

3

Downloading data from gus

The module for Polish tax numbers (NIP) will automatically complete the form with address data in a few moments after entering the NIP number.

The module integrates with the largest official tax number databases:

VIES

Verification of tax numbers in the official database of the European Union

- VAT

- VAT-EU

VATapp

Backup verification of tax numbers in the European Union

- VAT

- VAT-EU

GOV.UK

Verification of tax numbers in the UK (Wales, Ireland, Scotland, United Kingdom)

- Company number

- VAT-UK

GUS

Verification and completion of company address data in Poland

- NIP

- VAT-EU

If you want to check your tax number in other countries' tax number databases - open a request on HelpDesk.

The module will detect address forms in the order, during account registration and when editing addresses in the customer account.

Correct validation

The module will highlight the tax number field in green if the tax number is correct and active.

Erroried validation

The module will highlight the field for tax number in red and inform the customer about the error.

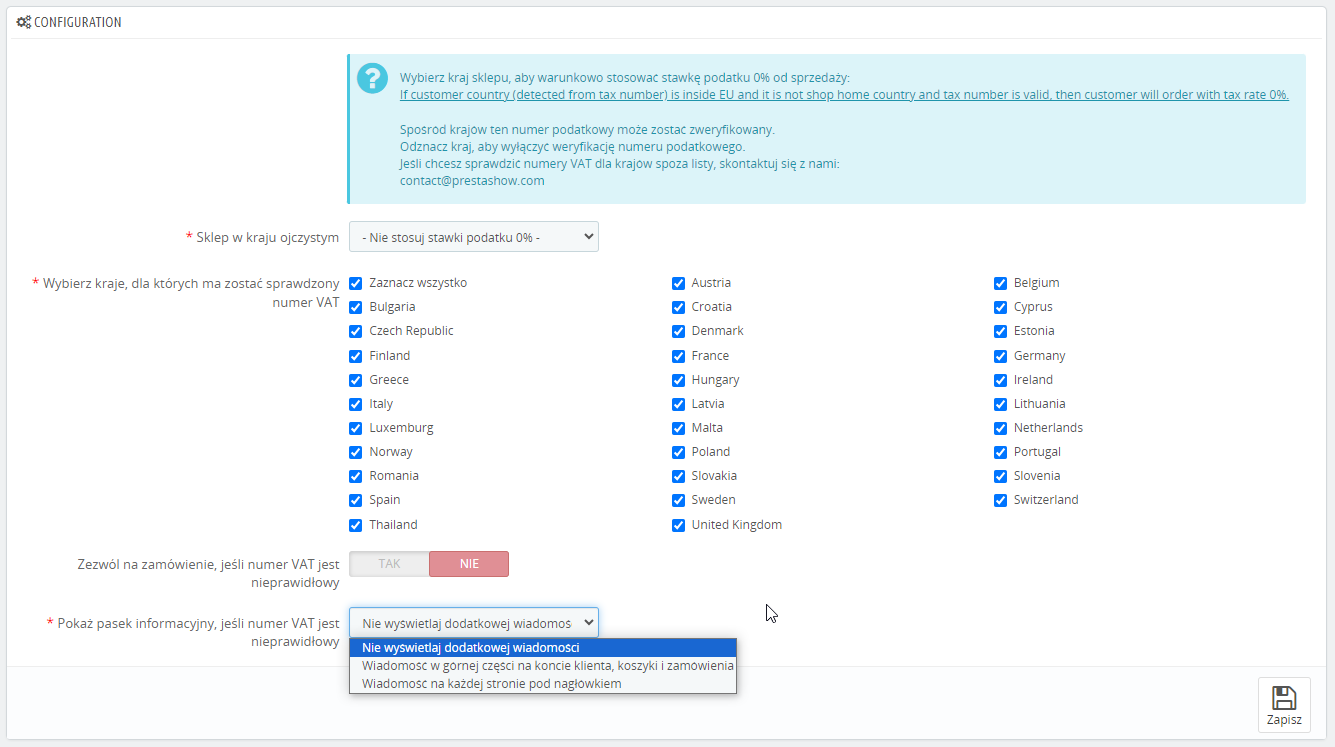

Simple configuration

In the module configuration, indicate the home country of your store. Select the countries for which you want to check the tax number and automate the 0% VAT rate.

0% VAT rate automation

Charge VAT 0% for orders from outside your home country, but only with a verified tax number.

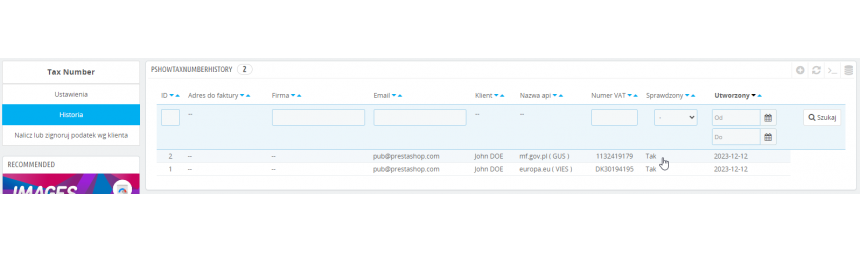

Validation history - your safeguard

In the module, you'll find tax number validation history and response history from VIES and VATapp systems.

Application of VAT 0%

The module can automatically change the VAT rate to 0% if the tax number of a customer from outside your home country passes validation.

A foreign customer who does not provide a valid tax number can place an order as a private individual and will be charged VAT.

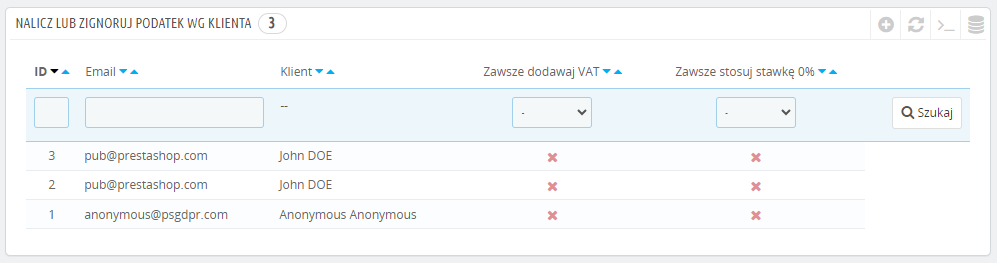

Exclusions

- You can indicate the countries for which validation of the tax number will not take place

- You can indicate customer accounts for which 0% VAT will always be charged, regardless of the result of the validation of their tax number.

- You can indicate customer accounts for which the corresponding tax will always be charged

Messages

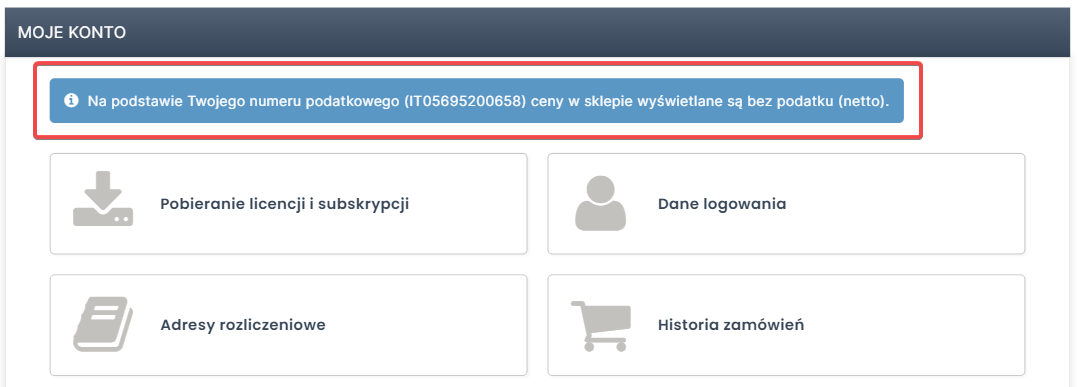

If your foreign customer passes validation, the module will display a message in My Account about the 0% VAT rate that will apply to purchases in your store.

In the module configuration, you can choose which messages you want to display for the customer:

- 0% VAT rate message in My Account / in the shopping cart / when placing an order.

- Information at the top of the page throughout the store.

- Information only when editing the billing address.

Validation process of saved tax numbers in customer addresses:

The module validates all tax numbers saved in the addresses on the customer's account, including addresses added before the installation of the module.

Validation of the tax numbers saved in the customer's account is done in the background, when the customer logs in to your store.

If any of the tax numbers on the customer's account turns out to be inactive, the module will display a message to the customer with the information.

ERP programs

Programs, e.g. ERP will retrieve from your store the correctly formatted and active tax number and the corresponding VAT rate.

Satisfied customers

You won't lose foreign customers who expect orders with 0% VAT.

Module: PrestaShop Invoices and E-Paragraphs

Invoice sales directly in your PrestaShop store.

Check out our module for invoicing sales and issuing E-Paragons.

Issue all types of invoices and E-Paragons directly in your PrestaShop store, and give your accountant a PDF invoice package and 1 file to import invoices into her accounting software.

Technical Requirements

- PHP 7.1 - 8.x

- Server extension ionCube Loader

- PrestaShop Importer only: PHP libxml version > 2.9.3

- PrestaShop Facebook Integrator only: PHP 7.2 or higher

- PrestaShop VAT Validator only: PHP SOAP

Support = Updates + HelpDesk

You get 90 days (3 months) access to the complete PrestaShow support package.

Module updates

Modules will inform you about available updates. Read the changelog and perform a 1-click module update directly from your store.

HelpDesk panel

This is the panel where we will provide you with help. On HelpDesk you can report problems, order free module installation and updates, and order modifications and custom programming work.

Extend support

After support expires, you can use the module without any restrictions. You can extend your support access at any time you need it.

Knowledge Base & FAQ

Free forever

The knowledge base is available to everyone. You will find module documentation as well as instructions, videos and answers to frequently asked questions.

Lifetime license for the module

- You can use the module without limitation in 1 store = 1 domain.

- You can use an additional domain, e.g. for developer copy.

- For a small fee you can change the domain for the module yourself.

Additional domains for Multistore

- All our modules support PrestaShop Multistore.

- Supporting unlimited domains for PrestaShop Multistore requires purchasing multistore support for the module.

Modifying the code

- The module code related to the integration with the store and the design (.tpl, .css, .js) has open source code and you can modify it freely.

- The module's source code (.php) is encrypted with ionCube, and modifying it will void the warranty.

Demo - test the module

- You can test the module in our demo store.

- You can find the link to the demo store in the top section of ⬆️.

- If you have any problems with the operation of the demo, please contact us

No entries yet.

Mam pytanie: czy planujecie autouzupełnianie danych o firmie na podstawie podanego numeru NIP z GUS? :-)

Gdyby coś się działo skorzystajcie z helpdesk.prestashow.pl

- robię zakup i podaję NIP UE, odlicza się VAT (stawka 0% się ustawia)

- przez finalizacją zakupu cofam się do formularza adresu i dodaję nowy adres, tym razem bez NIPu (a co tam, jednak chcę kupić prywatnie)

- pomimo że pole NIP jest puste i oznaczone jako opcjonalne, wyskakuje błąd że NIP nieprawidłowy

. - Nie mieliśmy okazji testować, ale jeśli Twój moduł używa standardowych mechanizmów PrestaShop do przetwarzania adresów, działanie modułu powinno być prawidłowe. Jeśli będzie inaczej - wycenimy dostosowanie działanie modułu do Twojego koszyka.